COVID-19 Events and Stock Market Returns

Article by Caroline Houghton.

The entire world saw uncertainty at an unprecedented level in 2020 due to COVID-19. Universities, workplaces, shopping malls, and many other popular locations closed as people all over the world quarantined in their homes. Uncertainty related to COVID-19 and how long it would impact our lives led to high volatility and unusual behavior in the stock market. In a recent NBER working paper, “What Explains the COVID-19 Stock Market?”, Cox, Greenwald, and Ludvigson, state that, during the COVID–19 pandemic, the market was reacting to a feeling and not real conditions. They write that “market movements during COVID-19 have been more reflective of sentiment than substance.” In this article, we use an event study analysis to explore which news events align with movements in the stock market. Understanding how and why the market reacted to some events and not others is an important tool for economic recovery.

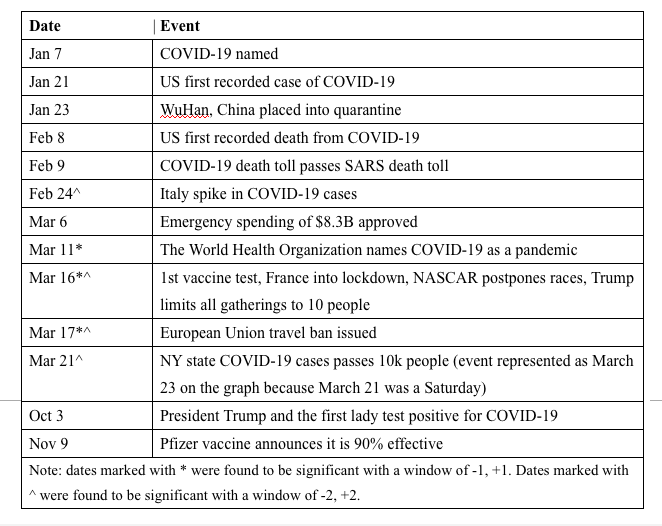

To do this analysis, we create a list of thirteen major events and examine the relationship between the event dates and the S&P 500 daily returns. The sample runs from January 2020 to early November 2020, and most of the events occur in the earlier months with some later extremely significant events added in, to see if much later events shock markets more than earlier ones. The events used in our timeline are:

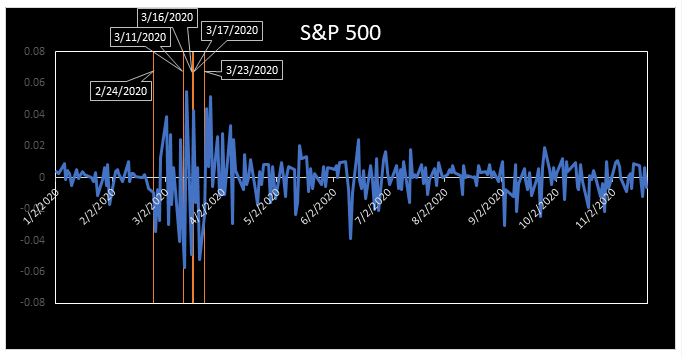

In the event study regression analysis, we explored event windows of -2, -1, 0, +1, and +2. We found that the only robust and significant results occurred for the March 16 and 17 events. Other events, which appear significant in some regressions but not others, are February 24, March 11, and March 21. The figure below graphs the S&P 500 daily returns with orange bars corresponding to the dates where we found meaningful events.

Surprisingly, across the event window specifications, the events: COVID–19 named (Jan 7), US first case (Jan 21), WuHan, China placed into Quarantine (Jan 23), US first recorded death from COVID–19 (Feb 8), COVID–19 death toll passes SARS death toll (Feb 9), emergency spending $8.3B approved (Mar 6), President Trump and the first lady test positive for COVID–19 (Oct 3), and Pfizer vaccine announces it is +90% effective (Nov 9) — all had no effect on stock returns. Because the news on events earlier in the year were primarily China with only small events in the US, perhaps the effect didn’t register in US markets. A possible mechanism to explain the later event results is a “numbing” effect to news. As news of case counts, deaths, and policy actions hit the American people nearly every day, the market appeared numb to the news after March. The overload of information may have made it so that even the most surprising of stories was getting lost in the mix. This finding aligns with Cox, Greenwald, and Ludvigson (2020) in that the stock market does not seem to be reacting to substance and further demonstrates that the events in March were so tumultuous that the market may have become numb to both good news and bad news – an unusual reaction.