Article by Armine Kardashyan’26

Despite low unemployment, an increasing labor force participation rate, and robust GDP growth

this year, US consumers are still pessimistic about the state of the economy. Is consumer

sentiment becoming disconnected from economic fundamentals or do consumers simply weigh

recent inflation more heavily than these other positive indicators? To address this question, I

conducted an analysis of the historical determinants of US consumer sentiment to determine

whether recent pessimism is different, or whether it is simply the usual reaction to an economy in

this state. In fact, this time is not different: consumers are responding to basic economic factors

like GDP growth and inflation much as they have in past decades.

Gloominess about the economy’s prospects has continued for a third month straight amid

persistent worries about inflation, higher borrowing costs, and the world political environment.

Given that consumer spending constitutes about two-thirds of the US economy, it is important to

understand the state of consumer psychology as an indicator of aggregate demand. If consumers

are pessimistic about the state of the economy, they will tend to cut back on spending and save

more which in turn can lead to a slowdown in economic activity.

Policymakers and economists measure confidence by surveying households to gather their

evaluation of the health of the economy. The Conference Board’s survey consists of five

questions— two measuring household evaluations of current conditions and three measuring

household expectations for the next 12 months. They combine the answers into a single number

called the Consumer Confidence Index. Using quarterly data from 1987 to 2023, I ran a time

series regression to find out how the Consumer Confidence Index varies with changes to GDP

growth, inflation, housing prices, and stock prices.

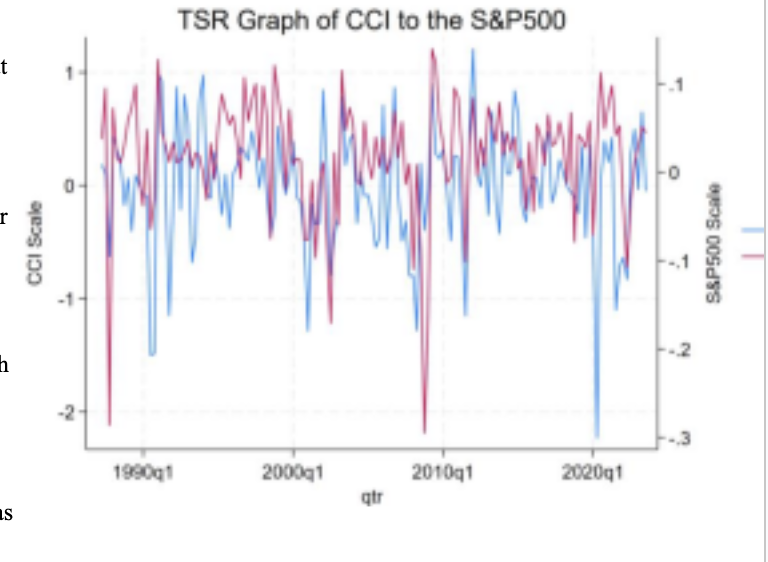

Figure 1: Time Series Regression Graph of Consumer Confidence Index to S&P500 Index

According to the regression analysis, consumers respond to GDP growth, inflation rates, and

stock prices, but not housing prices. Stock prices were found to have the greatest effect on

consumer confidence. The next greatest determinant of consumer confidence was inflation

followed by the GDP growth rate. Perhaps this is in order of relative salience more than the

relevance of the data to macroeconomic health. Stock prices are reported daily, while prices for

gas and groceries are also reinforced by daily observation. High inflation and a stock market that

has not yet returned to the summer 2022 peak may be sufficient to explain households’

uneasiness.

But is there perhaps something else depressing consumer sentiment: some non-economic factor?

In fact, there are a plethora of other determinants such as news or geopolitical conflicts that can

greatly impact consumer confidence.

We constantly get information about everything in the world from various legitimate or non-legitimate

sources that shape our depictions of reality. The recent coverage on the uncertainty of decisions in

the Federal Reserve can be an indicator to consumers that the economy is not stable.

Additionally, the rise of negative partisanship across news sources and political parties adds to

the political influence on confidence. This influence is further substantiated by the fact that

another determinant of confidence is whether the respondent supports the party in the White

House. The increasing pessimism, hence, might suggest an increasing dissatisfaction with the

Biden Administration.

Lastly, international tensions and conflicts also play a role in affecting US confidence. Given the

tense political climates throughout Europe, and recent conflict in the Middle East, consumers

might anticipate America’s involvement to negatively impact the US economy.

Figure 2: Error Graph of Consumer Confidence Index

To address the initial question posed, we can look at the difference between actual consumer

sentiment and the consumer sentiment that can be explained by our four economic factors. This

“residual” is the part of consumer sentiment that must be attributed to other factors. While the

most recent value is negative, it is quite small, suggesting that current consumer sentiment is in

line with current economic conditions. Moreover, while values were strongly negative at some

points during the pandemic—understandable given the potential economic impacts of the

crisis—there is little evidence that these non-economic factors are more important now than in

the past.

Despite the Biden administration’s factual trumpeting of historically low unemployment and

robust economic growth, consumer sentiment is, as it always has been, more focused on inflation

and the stock market. Which is why consumers remain less than fully optimistic about the

economy.

Article by Armine Kardashyan’26

Economic Journalist

Lowe Institute of Political Economy