Article by Rutvij Thakkar ’26

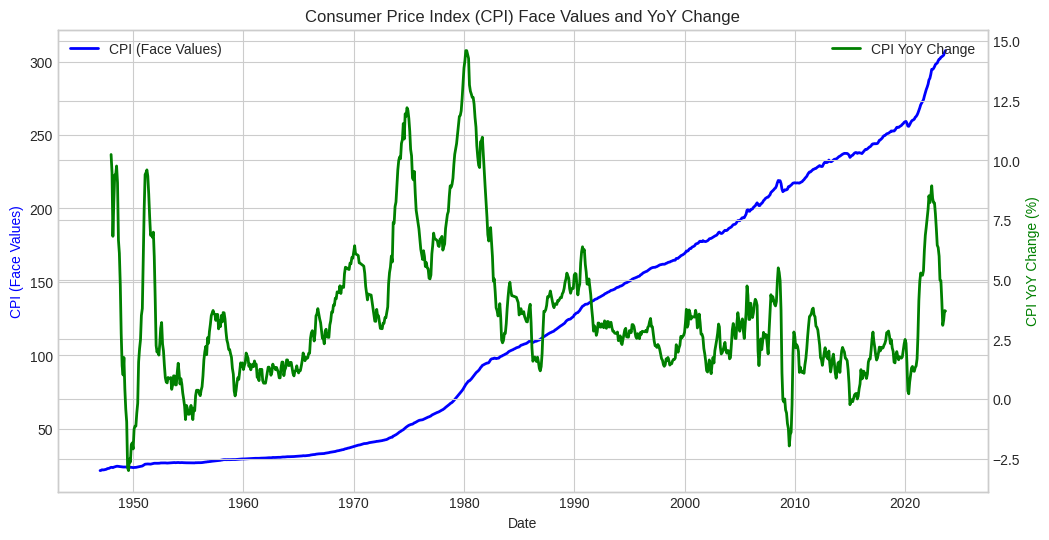

After the Fed contended with October’s inflation report, economist Paul Krugman declared that the “war on inflation is over.” – while this war and subsequent victory wasn’t necessarily defined, it’d be fair to say that most Americans don’t feel like the sting of inflation has gone anywhere. And saying we won at “very little cost” may not be entirely ingenuous because the CPI level is still up from 260 in February 2020 to 307 as of September 2023.

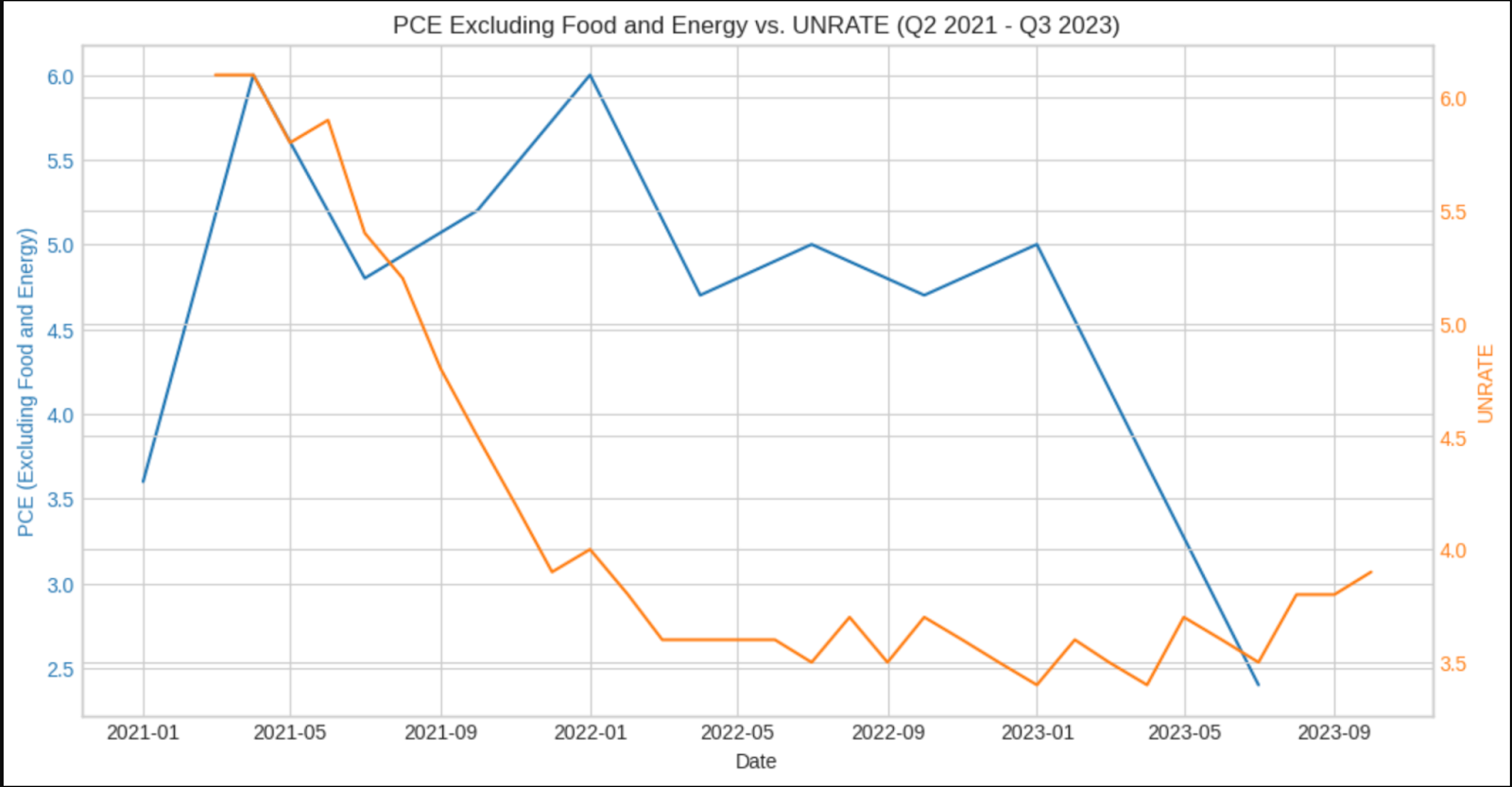

Economists measure the cost of disinflation by the rise in unemployment or decline in GDP that was required to lower the rate of inflation. Since January 2022, CPI ex-food, energy, shelter, and used cars have declined to the Fed’s target 2% level with virtually no rise in unemployment. It’s plausible that based on this narrow definition of inflation, we can say that the worst is probably behind us. But this narrow definition is dissociated from the experience of the consumer.

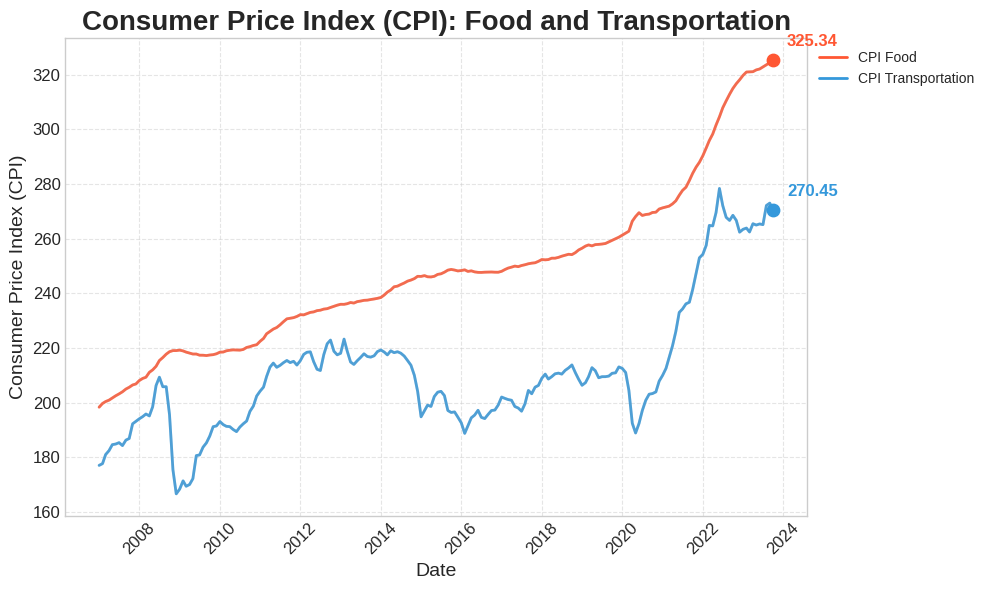

The Fed and macroeconomists generally define narrow measures of inflation for the purposes of prediction. The most commonly cited metric is core inflation, which excludes food and energy because changes in these prices are not persistent, and thus, past changes do not predict future changes. No monetary or fiscal policy can change an extraneous circumstance such as the war in Ukraine. During the pandemic, other prices dissociated from the general, persistent demand pressure that monetary policy affects. Attempting to understand the behavior of prices, economists tracked new, narrower inflation measures. One of the newest metrics is “supercore” inflation, which comprises only the price of services. Supercore strips out the tangible goods affected by the snarling of supply chains during the pandemic. Because monetary policy operates with a significant lag, macroeconomists think of wringing out the persistent inflationary pressures likely to deliver future inflation. Thus, they focus only on price rises, which are likely to persist. But consumers still need to buy the goods whose volatile prices have risen so steeply, even if those prices are unlikely to continue their rise. It’s fair to see why the average consumer seeing an “inflation is over party” might be left scratching their head.

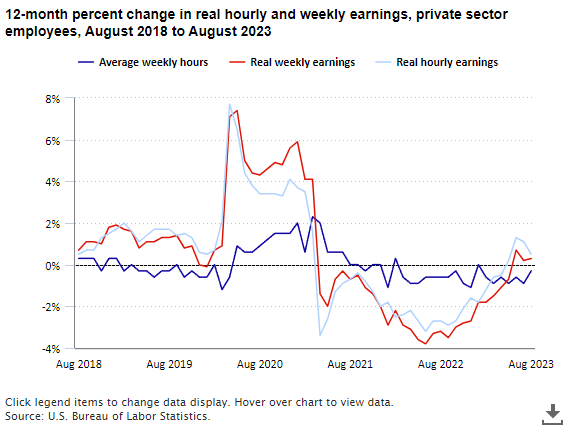

Wage rises did not keep pace with price rises during the inflationary burst, resulting in declining real incomes. Between March ‘21 and July ‘23, real incomes were lower than 12 months previously. And price levels are unlikely to decline to pre-pandemic levels. Reducing prices requires either reducing labor costs or reducing firm profits. So long as firms continue to have the pricing power to maintain mark-ups, inflation is tamed only by reductions in real wages. Historically, this often occurs via a bout of high unemployment, which reduces the ability of workers to bargain for wage increases. Over the past 18 months, workers could not command wage increases commensurate with headline inflation despite low unemployment. Thus, disinflation was achieved at virtually no cost in unemployment but necessitated a significant decline in real wages nonetheless.

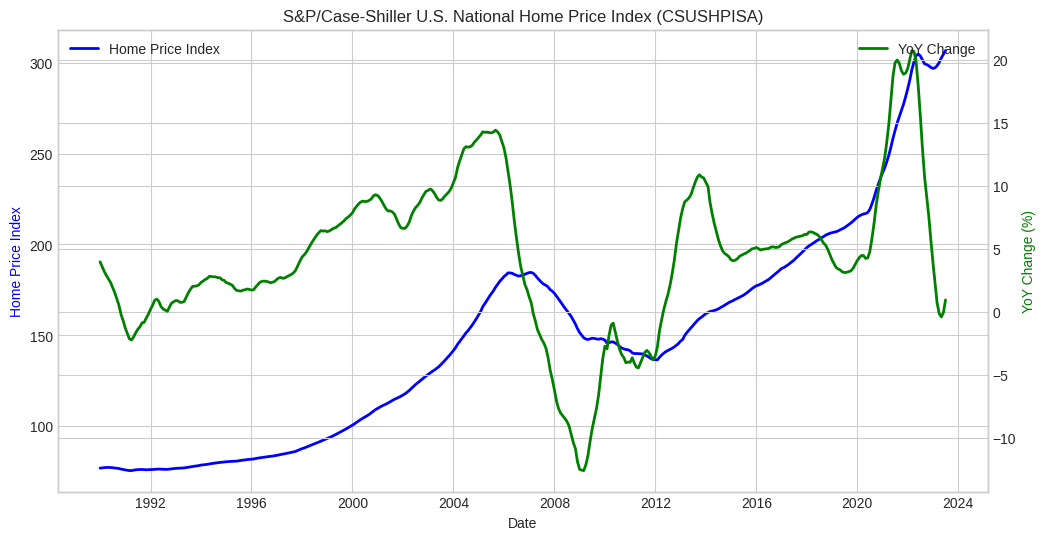

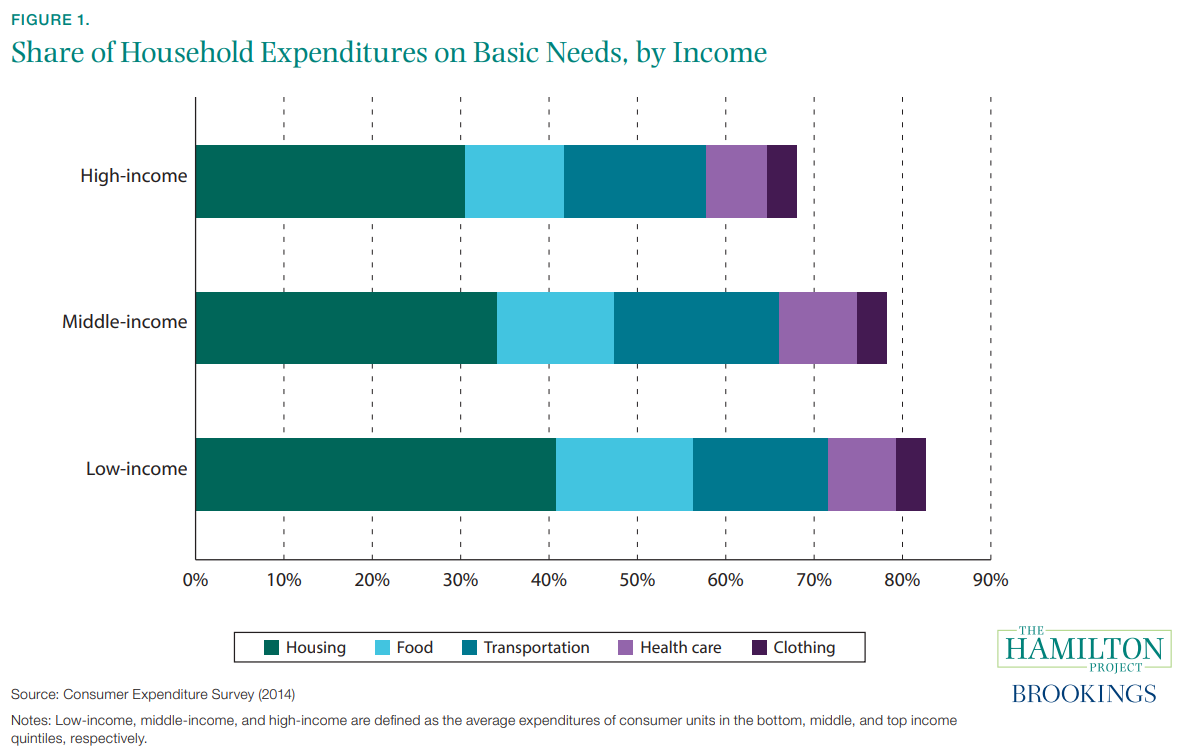

Core inflation excludes volatile factors like food and energy. New “super-core” measures have frequently excluded housing as it too has become decoupled from likely future price rises. Yet food, energy, and housing, whose prices remain elevated even if not likely to rise further, comprise a significant fraction of total household spending. The Case Shiller home price index is up 46.5% since the start of the pandemic, and 6.8% YTD. The price index for food and transportation are up 24% and 32.4% since the pandemic, respectively. Low-income households, in particular, face the brunt of these price surges, with housing accounting for a staggering 41% of their spending, as highlighted by the Brookings Institute. Moreover, the next 30% of their expenditure is distributed between food and transportation, two sectors that have experienced significant inflationary pressures.

Despite the focus on narrow measures of inflation by policymakers, who are concerned with preventing future inflation, the reality for consumers, especially those with limited financial means, is an irreversible increase in the costs of the essentials, reducing their purchasing power and contributing to a strain on overall economic well-being.

Headline inflation continues to persist at elevated levels, surpassing the Federal Reserve’s target for core inflation set at 2%. Despite the resurgence of real wage growth, the illusion of “costless” inflation during the recent economic measures unveils a different reality—one where the enduring consequences manifest as lost real wages. While the central focus on narrow inflation metrics may suggest a semblance of control, the sustained high prices in crucial sectors like housing, food, and transportation underscore a more profound challenge. These permanently elevated costs pose a lasting burden on households, affecting their overall financial stability and purchasing power. Real wages, though showing signs of recovery, struggle to keep pace with the soaring expenses, resulting in a tangible erosion of individuals’ standard of living.

Numerous additional factors contribute to the amplification of experienced inflation, with the current surge in interest rates playing a pivotal role in elevating the costs of essential goods. The tightening of monetary policy has led to an increase in interest rates, resulting in more stringent and expensive loans for crucial expenditures such as housing and automobiles. Notably, commercial bank interest rates on credit cards have soared to an all-time high, reaching 22%, marking an unprecedented level since the inception of this metric. Concurrently, the 30-year fixed mortgage rate has climbed to 7.2%, a threshold not seen in over two decades. This intersection of heightened leverage costs and the decline in real median household income since 2019 creates a challenging economic landscape for consumers. As borrowing becomes more costly, coupled with a dip in real income, it is unsurprising that individuals are increasingly expressing a sense of being priced out of today’s economy.

Article by Rutvij Thakkar’26

Economic Journalist, Lowe Institute of Political Economy

Claremont McKenna College