Are the Midterms Responsible For the Stock Market Decline?

Over the last few months, we seem to have witnessed a strong connection between political actions and the stock market. Perhaps the most important major recent political event was the 2018 federal midterm elections. Following those elections was a major stock market decline. Was the stock market decline caused by the election results?

Stock prices represent the sum of the expected future profits of publicly listed companies. Stock markets respond to news impacting those expected future profits. Changes in federal policy can affect profitability. A paper by Brian Knight, “Are Policy Platforms Capitalized into Equity Prices? Evidence from the Bush/Gore 2000 Presidential Election,” tested for the capitalization of policy platforms into equity prices. The study concluded that under the Bush Administration, Bush-favored firms were worth 3% more and Gore-favored firms were worth 6% less. Another study by Erik Snowberg, Justin Wolfers, and Eric Zitzewitz, “Partisan Impacts on the Economy: Evidence from Predictions Markets and Close Elections,” found that stock markets reacted to which party is in power. Electing Republican presidents were shown to increase equity valuations by 2-3% while also raising bond yields.

There were many reports predicting a downturn in the market after the midterms as the market had been doing well under unified Republican control and the Democrats were predicted to take over the house. The midterms saw the Democrats take the House, breaking the Republican trifecta hold over both houses of Congress and the White House. A split legislature would presumably interrupt Republican ability to pass public policy thus changing expected future policy. To the extent that these foregone policies would have improved future corporate profits, stocks would decline upon their being made politically infeasible by a Democratic House.

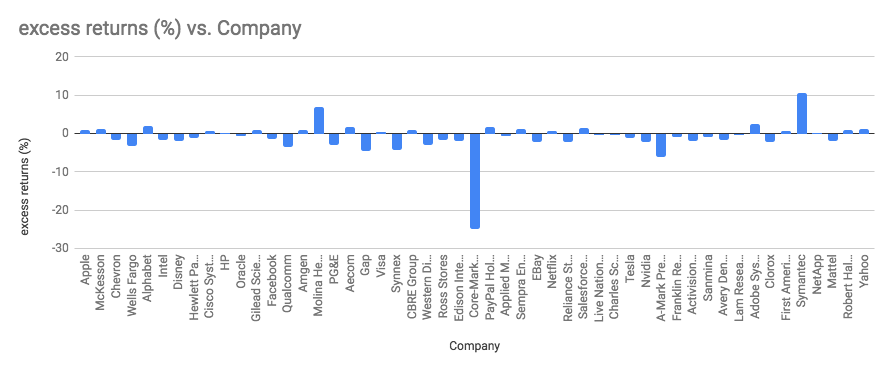

In order to see the effect that the midterms had on the stock price of Southern California companies, we calculated the average excess returns rate of these companies’ stock. The excess returns rate measures how much investment returns exceed the return on a benchmark that is considered to be risk-free. A positive excess returns rate indicates that the investment outperformed the benchmark. A negative excess returns rate indicates that the investment underperformed the benchmark. We collected stock prices of 51 L.A.-based companies the day before and the day after the elections (November 5th and 7th, respectively) and determined the returns on stock investment. For the benchmark, we used the treasury yield curve rate on a 3-month investment on November 7. From there we obtained the excess returns rate from all 51 companies for an average of -0.01%.

Surprisingly, we found virtually no election-day response for L.A. based companies. An average excess returns rate of -0.01% indicated a relatively stable market with a slight downward trend. An analysis of a 51 publicly traded companies in L.A. demonstrated that the elections did not have a profound effect on the stock market. The stock market tends to stay steady in the day proceeding elections. Even after President Trump’s surprise win the 2016 elections, markets stayed steady. That seems to be the case when looking at L.A. companies’ stock returns the day before and after the election. All stocks stay remarkably steady, most followed a similar trend path that they were on before election night. Only 6 out of 51 of top L.A. companies’ stock fell after the election. When stocks did go up and down it was not by a significant margin. The average excess returns for all 51 companies is -0.01%. On average the rate of return on risk-free investments, like treasury yields, was higher than the rate of returns on L.A. companies’ stock the day after the election.

Previous studies show that the stock market does well after midterm elections. In the months preceding the midterms, however, the stock market saw major drops and has been unpredictable. There are several factors unrelated to the elections that can account for the volatile nature of the current stock market such as the Federal Reserve’s interest rate increase, ongoing trade disagreements with China, and the government shutdown.

One reason that the market did not react to the elections may be that the results were not a surprise. As expected, the Democrats flipped the House, but Republicans retained the Senate and the White House. Most people expected the House of Representatives to flip in favor of the Democratic Party. According to fivethirtyeight.com on the morning of the elections, Democrats had a 7 in 8 chances of taking the House. Republicans were largely favored to retain the Senate as well, with fivethirtyeight.com giving them 4 in 5 chances. Stock markets incorporate all available information, so these predictions were already taken into consideration in prices on the 5th. Since election day carried very little news (the probability of divided government increased from 80% to 100%), there was not a stock market reaction.

While the government’s economic policies often move the stock market, it appears the predictable 2018 midterm elections did not for LA companies.