The Musk Multiplier

Article by Elliott Thornburg.

What can be gained from one of Elon Musk’s tweets? Maybe a humorous chuckle at a meme comparing a robotic crane to male genitalia. Or perhaps a slightly updated perspective on the potentially catastrophic risks of artificial intelligence. How about fourteen billion dollars? When Elon Musk tweeted “Gamestonk!!” in late January, he helped increase the market cap of the nearly defunct video game retailer GameStop (GME) by fourteen billion dollars in a single day. The GameStop mania is one of several similar instances where a single tweet from the business magnate briefly spiked the value of public securities. At the Lowe Institute, we tracked the stock prices of several corporations to determine if Musk’s tweets add lasting value in addition to volatility.

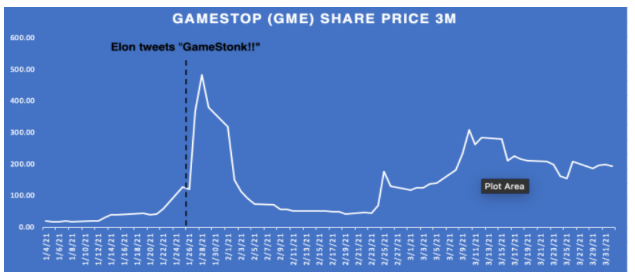

The well-known events surrounding the eye-watering ascension of GameStop at the onset of 2021 are a good place to begin shedding light on Musk’s market influence. The infamous Reddit group, r/WallStreetBets, popularized a potential “short squeeze” investment strategy in the heavily shorted GameStop in early January. Within one month, the stock went from just under $20 per share to an all-time high of $483 before leveling out in the low fifties. While a cacophony of influential voices added to the GameStop mania, Elon Musk’s contribution stands out above the rest.

Eight minutes after trading stopped on January 26, Elon Musk tweeted “GameStonk!!” and linked the r/WallStreetBets subreddit to his 49 million followers. Over the next twenty-four hours the share price doubled, ending the day at $347.5 a share, increasing the company’s market cap by over $14 billion. The tweet didn’t only impact the share price. The r/WallStreetBets subreddit gained over a million subscribers in the day following Elon’s tweet. Google Trends shows the search interest in the term “GameStonk” went from nonexistent to 100% following the tweet.

But did Elon’s tweet create any lasting value for GameStop? It’s difficult to tell. While the share price decreased significantly in mid-February ($50 per share), Elon’s tweet still did help double GameStop’s stock price briefly and as of writing this article, the price of a single GameStop share is hovering just under $200 dollars after another manic rally in early March. Yet, the return to an earth-ish share price in early February and the sheer number of possible influences at play reveal an opaque causal link at best.

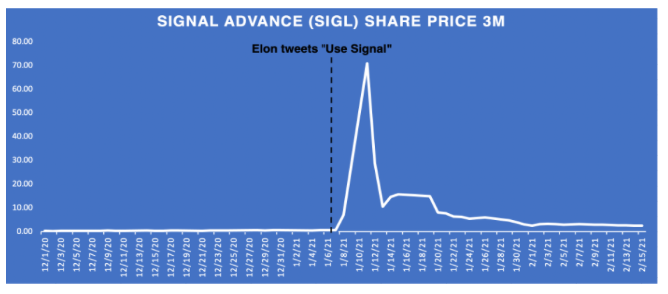

Perhaps the best example of the Musk Multiplier occurred just several weeks before the GameStop saga. On January 7th, Elon Musk tweeted “Use Signal” referencing a popular encrypted messaging software. In what can only be described as absurd, the price of shares in a completely unrelated biomedical technologies company, Signal Advance (SIGL), increased from $0.60 on the day of the tweet to a peak of $70.85 four days later, an 11,700% increase. The market cap of Signal Advance went from between $3 – $6 million to a peak of over $404 million within a week.

One of Signal Advance’s main competitors, Garmin Ltd, saw a .2% decrease in its share price over the same period, making clear there was no broad event within the industry. While Signal Advance would enjoy their nearly half a billion-dollar market cap for less than a day, its current market cap of nearly $22 million dollars is still five times what it was before Musk’s tweet. In Signal Advance’s case, Elon didn’t just create short term volatility, he created over $15 million dollars of residual value with a tweet.

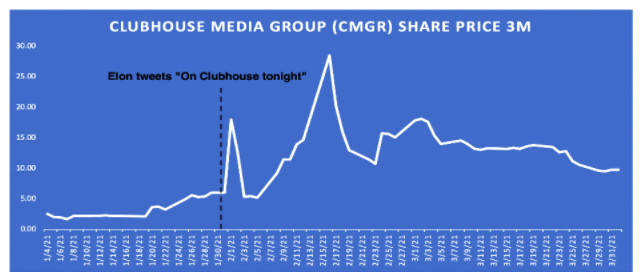

A similarly baffling example played out with Clubhouse Media Group Inc (CMGR). On January 31, Elon tweeted “On Clubhouse tonight at 10pm LA time,” in reference to an audio-based social media app. An unrelated influencer manager company, Clubhouse Media, watched its shares increase from $6 dollars per share to a high of $17.99 the following day. Two weeks after the tweet, the stock price jumped up to an all-time high of $28.43 before gradually leveling off around $9 dollars as of April. The Musk Multiplier increased Clubhouse Media Inc’s market cap by 50%, or roughly $456 million dollars, over a three-month period.

The Musk Multiplier is apparent in numerous other incidents over the past several months. Throughout January and February of 2021, tweets from Elon Musk significantly spiked the share price of Etsy (ETSY) and Sandstorm Gold Ltd. (SAND). In the case of Sandstorm, Elon Musk tweeted “Sandstorm is a masterpiece,” referring to the hit techno song by Darude, and inadvertently increased the share price of a Canadian gold miner, Sandstorm Gold, 55% in pre-market trading. However, in both of these cases the Musk Multiplier only shortly spiked the share price. Shares of both companies are trading for less today than when they graced Elon’s twitter.

Finally, the mixed bag which is Dogecoin. In early February, Elon sent the price of the meme cryptocurrency Dogecoin 75% higher after tweeting “Dogecoin is the people’s crypto,”. Yet after several other tweets such as “Dojo 4 Doge” and whatever this is, the price of the coin has decreased, or increased, or stayed the same. The Musk Multiplier is evidently a more complicated phenomenon than initially suggested, working in some instances and not in others. So, is the Muskiplier anything more than extreme volatility at the hands of the world’s wealthiest meme artist? In some instances, yes. As GameStop, Signal Advance, and Clubhouse Media show there are evidently cases where a seemingly random tweet from the billionaire can create millions of dollars in lasting value. And in others, such as Sandstorm Gold and Dogecoin, no. It seems the Musk Multiplier is more of a spotlight than anything else: shining light on ideas, companies, and public securities for a broad base of retail investors.