Is the Commuting Price Right?

What could be worse for Inland Empire commuters than the daily, lengthy drive into Los Angles? Having to pay a per-mile tax on that ride. With the LA County Metro Transit Authority considering a congestion tax, we performed an analysis to predict the cost of Inland Empire workers commuting to Los Angeles.

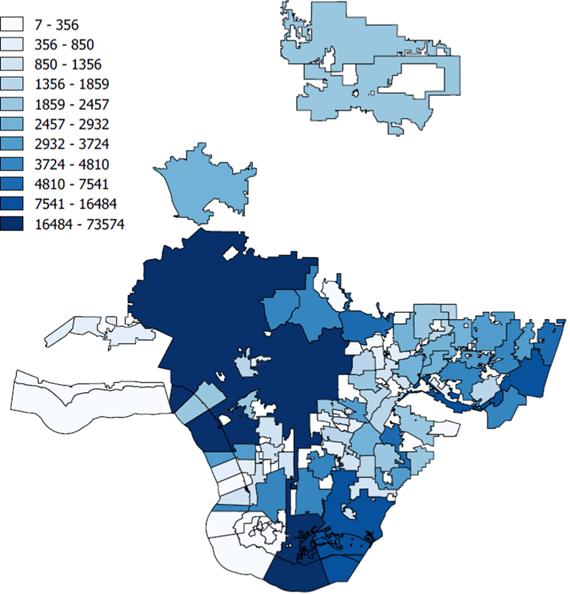

No matter how many lanes are added, the Los Angles metro area has a serious traffic problem. The average LA driver lost 128 hours sitting in traffic in 2018, according to a report from INRIX. This congestion costs $1,788 to each individual driver, the sixth highest congestion cost per individual in the world. The city has prioritized reducing travel times through different means in the past – privately funded toll roads, additions to public roads, and increasing public transportation – but nothing has proven effective. Demand for travel is highly elastic: when congestion is successfully reduced, making a trip easier, people decide to take more trips, rapidly restoring the prior level of traffic. With only the inconvenience of traffic to restrain demand, we are doomed to a high level of congestion. In order to cut down congestion and get the city ready for an influx of people in the 2028 Olympics, the Metropolitan Transportation Authority is now considering a tax per mile driven in LA county. An additional cost, beyond the time of a trip, may dissuade travelers, leading to reduced traffic and faster travel times. While this measure could cut congestion, it will certainly impact commuters who work in Los Angeles County.

Los Angeles would not be the first major city to implement congestion pricing. In the 21st century, cities including London, Singapore, Milan, and Stockholm have employed this tactic. While unpopular at first, congestion pricing has been effective in these cities. Miles driven usually decreases by 15 to 20 percent, according to a 2019 report by TransForm.

While Los Angeles officials have not stated what the per-mile tax would be, a pilot program for a similar per-mile congestion tax in Washington has a proposed rate of 2.4 cents. For our analysis, we used 3 cents per mile.

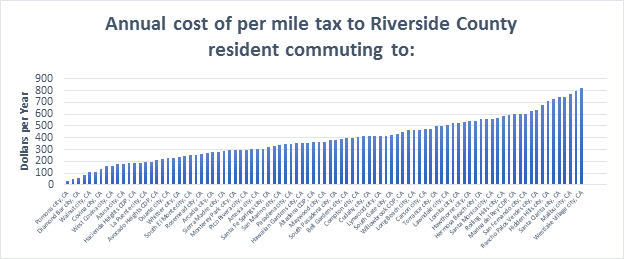

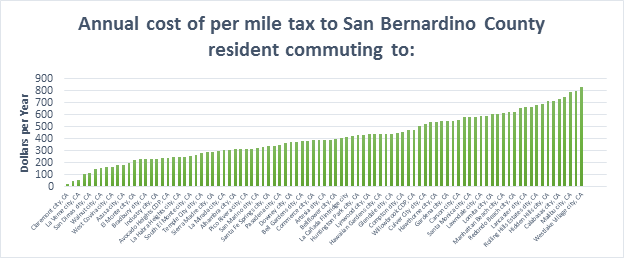

Residents of both Riverside and San Bernardino County commute to all 94 cities in Los Angeles County. Riverside residents were assumed to use Highway 60, and San Bernardino residents were assumed to use Highway 210. We calculated the distance to each LA City from a common highway point at the edge of LA county. (We left out Avalon which is within the county but on Catalina Island.) This round trip distance-within-LA county was multiplied by the 3 cent mile tax to calculate the daily cost of the per mile tax for each County’s commuters.

The highest annual tax for a San Bernardino resident would be $828 for a year commuting to and from Westlake Village. The lowest would be a mere $19.2 for those who just tiptoe across the county line to Claremont. For Riverside commuters, the highest cost would be $824.4 to Westlake and the lowest would be $37.2 to Pomona. If all the residents continued to commute, a 3 cent per-mile tax would generate $878 million from Inland Empire commuters over a decade. While The Metropolitan Transportation Authority has yet to state the per mile rate under consideration, the agency did approximate a $102 billion revenue from a decade of the congestion tax implementation. Our estimated figure is less than 1% of this number. While we consider only IE commuters and not LA residents or non-commute trips to LA, the disparity suggests that the LA MTA is considering a higher tax rate than the one we have analyzed.

The Metro has yet to announce any tax estimate, but when they do, don’t be surprised to see a higher per mile tax if the Metro plans to generate their expected revenue.

While the tax has ways to go before even becoming law, the Metro did unanimously vote on the 28th of February for a comprehensive congestion pricing study. If it goes forward, IE commuters could look forward to swifter commutes, but at an unknown, potentially high price.